HOW MUCH IS YOUR PRACTICE LOSING?

Consider This

On average, 12% of claims submitted by private practice owners go unpaid due to submission errors. That’s a full 12% of revenue that goes uncollected for services rendered.

%

Properly Submitted

%

Coding Errors

%

Untimely Filing

%

Carrier Misidentification

How To Maximize Reimbursement

Verify patient eligibility and determine which insurance company is primary. Also, asses whether special services require preauthorization.

Ensure proper ICD-10 and CPT code pairings. One digit can mean the difference between a paid and denied claim.

What Does 12% Mean To You?

Let’s estimate how much your practice might be losing because of faulty claim submission and follow up. This chart assumes average payment of $200 per claim.

The margin of loss per monthly submissions is $1,200 for ever 50 claims submitted.

A single mid-sized private practice provider submits approximately 4,000 claims annually.

That results in nearly $100,000 lost annually.

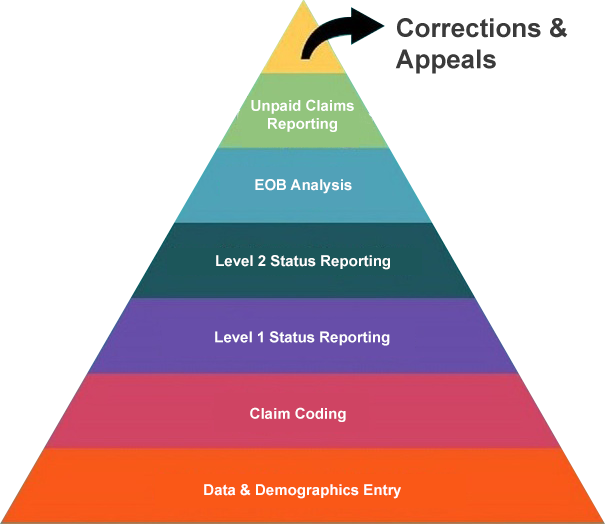

7 Stages of Claim Correction

There are 7 opportunities to correct a claim for proper processing. The likelihood of a claim being corrected at each stage works from the bottom up and errors are more likely to be caught at the earlier stages than the later ones. If the larger claim is outstanding, it is more likely to be overlooked, and proper payment is forfeited.

Ensuring claim optimization results in proper claim payment and increases in cash flow.

Catching mistakes in early stages allows for ample time to resubmit corrections.

At least 3 of these stages are overlooked causing delays in payment and loss of revenue.

We Can Lower Your Margin Of Error To 5%

No longer do you have to waste your time and energy trying to ensure that your claims are being reimbursed quickly and accurately.

Letting Us Bill For You

With less than a 5% error on submitted claims, we can help the average provider* increase their claim reimbursement by $60, 000 annually.

Managing Your Own Collections

Wasting time, energy, resources and money only to get cheated out of a claim reimbursements that are due to you.

*Assuming a practice that submits 4,000 claims annually, paid at an average of $200 per claim, that equals $800,000 in potential collections.

The billing and collections specialists at Infinite Medical Billing would be more than happy to evaluate your needs and devise an efficient custom made system tailored for your practice. Contact us today for more information.

Testimonials

I had the same lady doing the billing in my office for many years and when I realized it’s time for an upgrade, I was very nervous as I am very reluctant to change. So I turned to Infinite Medical Billing, and they assured me they will make the transition as smooth…

Diana Simkhovich, ODSo there was this patient. Claim kept getting denied. The reason was something stupid like “CPT code not payable with linked diagnosis,” when we all knew that was wrong. Yet appeal, after appeal, after appeal, they kept denying. I honestly was ready to give up and just let it go. But the ladies at Infinite wouldn’t let it go…

Vizon NY, LLC.After working for few years at the hospital, I decided to start a private practice. Soon I realized that seeing patients is not enough for building a successful practice and how unprepared I was to deal with arising billing issues. One of my colleagues connected me to Infinite Billing…

Inna Murzakhanova, MDAnyone who’s started a medical practice can tell you, the legwork almost certainly makes you want to cry. They don’t teach you this stuff in Med School. Applications, databases, endless slews of paper and signatures until your fingers bleed. Once you can take the insurances, you have no idea how to bill them…

Bronx Family EyeCare